As the digital economy continues to thrive, the need for secure storage solutions becomes paramount, especially when considering the intricate nature of passing on these decentralized assets to future generations. In this dynamic environment, cold wallets emerge as pivotal instruments in ensuring the safety and accessibility of cryptocurrency holdings.

Crypto Inheritance Planning

In the dynamic realm of cryptocurrency, the importance of thoughtful inheritance planning cannot be overstated. As digital assets become an integral part of individuals’ financial portfolios, it becomes imperative to consider the long-term strategies for passing on these assets to heirs. The unique characteristics of cryptocurrencies, such as their decentralized nature and complex security measures, necessitate a specialized approach to estate planning.

Challenges arise on multiple fronts when contemplating the transfer of cryptocurrencies to future generations. Firstly, the absence of centralized control, inherent to blockchain technology, poses a significant hurdle. Unlike traditional assets where centralized authorities facilitate the transfer of ownership, cryptocurrencies demand careful consideration to ensure a seamless transition. Privacy concerns add another layer of complexity, as the inherently pseudonymous nature of blockchain transactions can make it challenging to identify and access digital holdings. Legal and regulatory complexities further complicate matters, with jurisdictions varying in their recognition and treatment of digital assets.

To navigate these challenges effectively, it is crucial to educate family members about the intricacies of cryptocurrency assets. Transparent communication and a shared understanding of the digital wealth landscape foster a proactive approach to inheritance planning. By empowering heirs with the knowledge needed to access and manage crypto assets responsibly, families can pave the way for a secure and well-managed transfer of wealth across generations.

The Role of Cold Wallets in Inheritance Planning

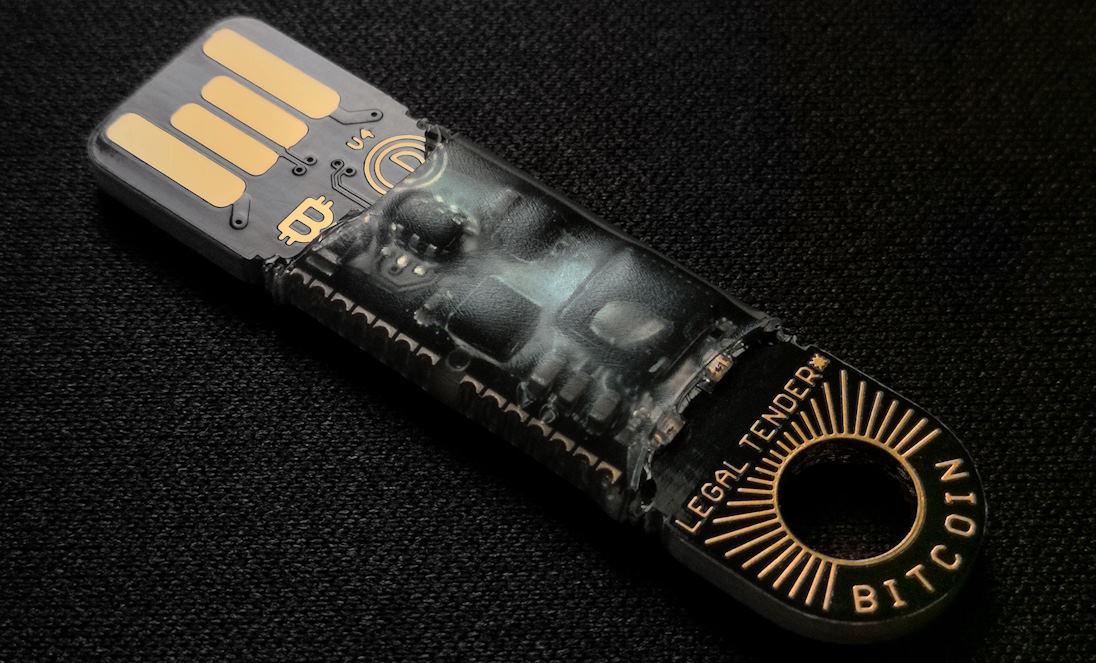

In the ever-evolving landscape of cryptocurrency, cold wallets emerge as indispensable tools in the realm of inheritance planning. Ensuring a seamless transition of crypto assets from one generation to the next is a multifaceted challenge, and cold wallets address this by providing an unparalleled level of security. These hardware or paper-based solutions, kept offline and immune to online threats, act as digital safes, safeguarding the inheritors’ access to valuable digital wealth.

Establishing clear instructions for heirs becomes a pivotal aspect of effective inheritance planning, and cold wallets play a key role in this process. By providing detailed guidelines on accessing and managing the cold wallet, owners can mitigate the risk of potential loss or confusion, ensuring a smooth transfer of assets.

To enhance security further, many cold wallets offer multi-signature features, requiring multiple private keys to authorize a transaction. This innovative approach adds an extra layer of protection, reducing the risk of unauthorized access or theft.

Integrating cold wallet solutions into estate planning strategies becomes paramount in ensuring a comprehensive approach to the management of digital assets. By incorporating these secure storage methods into legal frameworks and financial plans, individuals can proactively navigate the complexities of cryptocurrency inheritance, fostering a legacy that withstands the test of time.