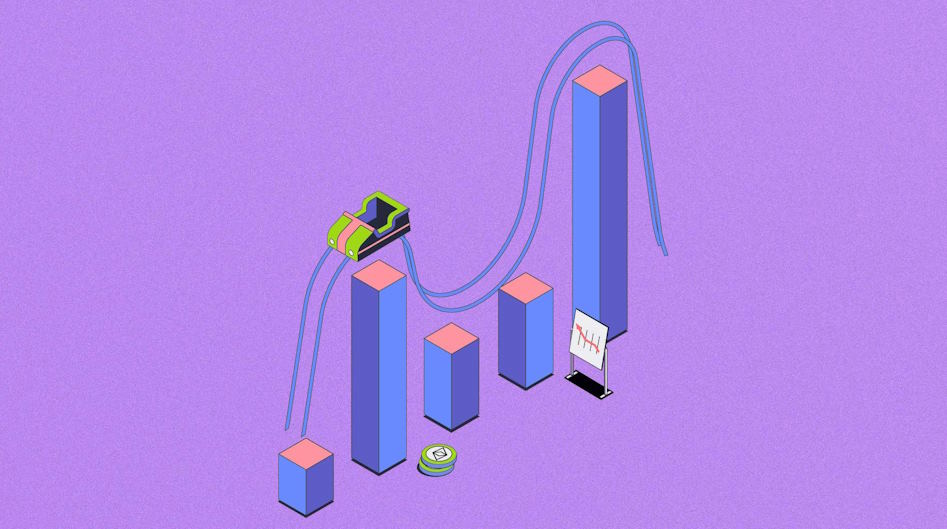

The cryptocurrency market, known for its unparalleled potential for both substantial gains and steep losses, demands a proactive and informed approach from investors. As market forces, regulatory changes, and global events continue to shape the crypto space, the importance of safeguarding your investments against volatility cannot be overstated.

Understanding Market Volatility

Cryptocurrencies are renowned for their inherent volatility, a characteristic that distinguishes them from traditional asset classes. Market volatility refers to the degree of variation in the price of a financial instrument over time. In the context of cryptocurrencies, factors such as regulatory changes, market sentiment, and macroeconomic developments contribute to substantial price swings. To navigate this landscape effectively, it’s essential to comprehend the nature and drivers of market volatility. Historical examples, including the infamous cryptocurrency market crashes, underscore the significance of being prepared for unforeseen fluctuations.

Risk Assessment

One of the foundational steps in safeguarding your cryptocurrency investments is conducting a thorough risk assessment. Evaluating your personal risk tolerance is crucial, as cryptocurrency investments can be inherently speculative and subject to sudden and significant price movements. Additionally, understanding the risk profiles of different cryptocurrencies and their correlations with traditional assets can provide valuable insights for constructing a resilient portfolio. By comprehensively assessing risk, investors can make informed decisions aligned with their financial goals and risk appetite.

Diversification Strategies

The age-old adage “don’t put all your eggs in one basket” holds true, especially in the volatile world of cryptocurrencies. Diversification is a key strategy for mitigating risk and optimizing returns. Allocating investments across different cryptocurrencies helps balance the overall risk exposure. However, effective diversification requires more than spreading investments randomly. Investors need to consider the correlation between different cryptocurrencies and traditional assets to construct a well-balanced portfolio that can weather market turbulence while potentially capitalizing on opportunities for growth.

The age-old adage “don’t put all your eggs in one basket” holds true, especially in the volatile world of cryptocurrencies. Diversification is a key strategy for mitigating risk and optimizing returns. Allocating investments across different cryptocurrencies helps balance the overall risk exposure. However, effective diversification requires more than spreading investments randomly. Investors need to consider the correlation between different cryptocurrencies and traditional assets to construct a well-balanced portfolio that can weather market turbulence while potentially capitalizing on opportunities for growth.

Secure Storage Solutions

The security of cryptocurrency holdings is a critical concern, particularly in an environment where cyber threats and hacking incidents are prevalent. Many investors store their digital assets on exchanges, but this practice exposes them to significant risks. Utilizing hardware wallets for secure storage provides an additional layer of protection against potential security breaches on exchanges. Implementing best practices for securing private keys and seed phrases further ensures that access to your cryptocurrency holdings remains in your hands, minimizing the risk of unauthorized access and loss of funds.