While the cryptocurrency space offers unprecedented opportunities for innovation and investment, it is not immune to the darker side of human behavior. Crypto pump-and-dump schemes have emerged as a troubling manifestation of market manipulation, taking advantage of the decentralized and relatively unregulated nature of the digital asset landscape. These schemes often unfold in the shadows of online forums and social media platforms, where coordinated efforts to pump up the price of a particular coin create a false sense of momentum. As investors increasingly flock to the promise of quick gains, the risks associated with these schemes become more pronounced.

Understanding Crypto Pump-and-Dump Schemes

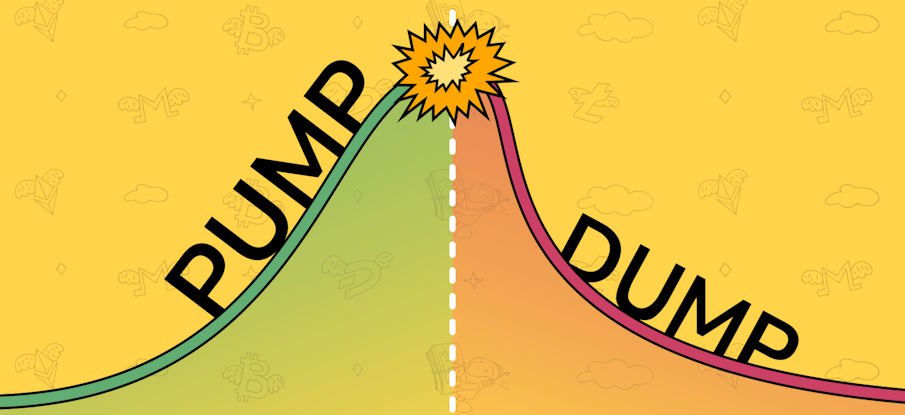

At its core, a pump-and-dump scheme involves artificially inflating the price of a particular asset through coordinated efforts, only to sell off quickly and leave unsuspecting investors with substantial losses. In the context of cryptocurrencies, these schemes often rely on the speculative nature of the market and are executed through online forums and social media platforms. Coordinated groups, often with significant influence, engage in manipulative tactics to create a false sense of momentum, luring in investors who hope to capitalize on quick gains. Notable incidents in the cryptocurrency space serve as cautionary tales, revealing the potential dangers inherent in these schemes.

Risks to Investors

The allure of quick profits draws many investors into the web of pump-and-dump schemes, but the risks associated with such endeavors are profound. Market manipulation plays a central role, with the artificial inflation of prices leading to a false perception of value. As the price reaches an unsustainable peak, those behind the scheme swiftly sell off their holdings, causing the price to plummet. Investors who bought in during the artificially inflated phase are left holding devalued assets, resulting in significant financial losses.

Moreover, the lack of regulatory oversight in the cryptocurrency market exacerbates the risks for investors. This regulatory vacuum creates an environment where bad actors can operate with relative impunity, posing a substantial threat to the integrity of the cryptocurrency market.

Psychological and Emotional Impact

Beyond the financial repercussions, pump-and-dump schemes have a profound impact on investor trust and confidence. The deceptive practices employed by those orchestrating these schemes erode the foundation of trust that is crucial for a healthy and sustainable financial ecosystem. Investors who fall victim to such schemes often experience a significant emotional toll, ranging from frustration and anger to a loss of faith in the entire cryptocurrency market.

The long-term consequences of widespread pump-and-dump activities extend beyond individual investors. The tarnished reputation of the cryptocurrency market may deter potential participants, hindering the growth and mainstream adoption of digital assets. As the crypto community strives for legitimacy, combating pump-and-dump schemes becomes essential to foster trust among investors and build a resilient financial ecosystem.

Regulatory Challenges

The regulatory landscape for cryptocurrencies is still evolving, and the challenges associated with prosecuting pump-and-dump perpetrators are considerable. The decentralized and pseudonymous nature of many blockchain transactions makes it difficult to trace and identify those responsible for orchestrating these schemes. Additionally, jurisdictional issues and the lack of international regulatory consensus further complicate efforts to bring perpetrators to justice.

Addressing the regulatory challenges requires a concerted effort from global regulatory bodies and the cryptocurrency industry. Increased collaboration between regulators, law enforcement agencies, and cryptocurrency exchanges is crucial to develop effective measures to detect and prevent pump-and-dump schemes. The establishment of clear and comprehensive regulatory frameworks will not only protect investors but also contribute to the long-term stability and credibility of the cryptocurrency market.

Red Flags and Warning Signs

Recognizing the signs of a potential pump-and-dump scheme is essential for investors to protect themselves from falling victim to such activities. Certain red flags, such as sudden and inexplicable price spikes, excessive hype on social media, and the lack of fundamental value supporting the price movement, should serve as warning signs. Education plays a pivotal role in empowering investors to conduct thorough due diligence before making investment decisions.

Educational resources that emphasize the importance of research, skepticism, and understanding market fundamentals are essential for creating a resilient and informed investor base. By arming themselves with knowledge, investors can make more informed decisions and contribute to the overall health of the cryptocurrency market.